Tags: Real estate, Investment, Millennials

For decades, the stock market has been where the majority of Canadians invested their savings with hopes of a high return. Whether looking to save for retirement, a future for your children, or a bucket-list trip, the stock market has been proven to provide returns and with the purchase of a mutual fund, through a bank or investment firm, millions of Canadians are investing this way each year.

Over the past five years, however, we are starting to see a new investment trend develop. As the millennial generation develops more and more buying power they are changing the way that a large percentage of Canadians are investing their money and we are seeing a shift in the overall market as a result.

Here are some of the reasons why millennials are investing in real estate today:

- Real estate provides an inflation hedge. Real estate prices and rental rates are growing much faster than the rate of inflation.

- Creating equity. This equity can be used to finance future investments.

- The returns on stocks and bonds are not stable and are not performing as well as they have historically.

Whether pre-construction or pre-existing, single-family, semi-detached, townhouse or a condo, we are seeing more and more millennials deciding that owning a home is the right investment decision for them. It can be a home that they buy and move into right away, a home they buy and move into a few years later, a home that is purchased and treated as a rental property, or a home that is purchased, renovated, and then resold – there are several ways to approach to treat real estate as an investment.

Keep in mind that if you are treating this purchase as an investment you do not always have to buy a property in the same city that you are living in. For example, if you are priced out of buying a house in Toronto, you can look to Hamilton or the greater Hamilton area to purchase an investment property. Houses in that market are much less expensive than in Toronto and can still provide all of the same benefits. Looking east to Pickering, or Oshawa, you can also find properties that are a relative steal compared to the Toronto market. These are great ways to get your foot in the door and buy your first investment property.

Below we will go over some different property investment approaches that we are seeing embraced by millennials and will touch on why investing in real estate is a great option for those that choose to.

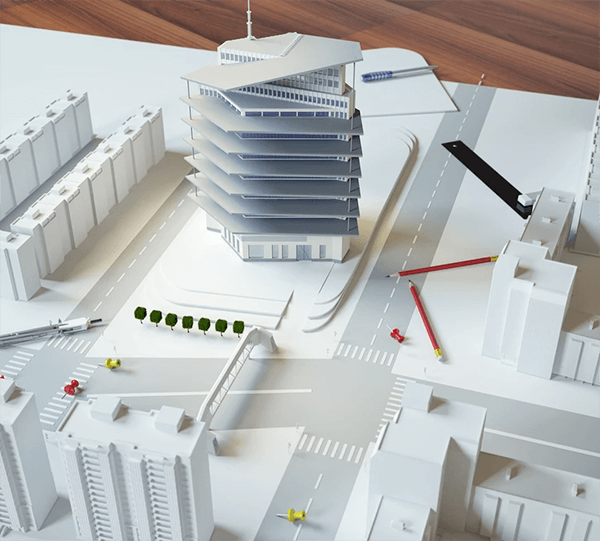

Pre-construction

A lot of millennials are opting to invest their money in a pre-construction property. It can be a condo, townhouse, semi-detached, or detached, the idea is that you get your money into the property as early in the building process as you can so that you have the greatest opportunity for the property value to rise before you take ownership.

When you compare the price of a pre-construction property that is being sold in the same neighbourhood and a comparable home that is already built, you will almost always get a more favourable price per square foot on the pre-construction property. This can be appealing to many investors as once the pre-construction home is built the value of the two properties should align and thus you have an opportunity to make a profit.

Another benefit in this example is that once construction is completed the pre-construction home will be newer than the comparable homes in the neighbourhood, which often means that it will be finished with newer and trendier finishes, floor plans, and amenities. When it comes time to sell your property having the edge with these types of things will come in handy and could help you get a higher selling price than their resale counterparts.

Pre-Construction properties will also come with a warranty which means that you will not need to fork out any cash for maintenance in the first few years, or at least not nearly as much as you would likely have to with a pre-existing property. If your pre-construction property is a townhouse or a condo that requires you to pay monthly maintenance fees, you can expect very low fees for the first few years as a result.

Lastly, and a follow up on the trendier finishes point above, with a pre-construction home you have complete control over the type of finishes, colours, and materials that are used in the home. Working with your builder, you can choose the appliances, type of flooring, countertops, cabinets, etc that meet your needs and not the preferences of the previous homeowner.

Rental property

Rental properties can be a great source of passive income and over time can provide a great return to any investor looking to make a profit. Rental properties provide recurring income with minimal effort from the owner which is one reason that they are so appealing to many as an investment.

When approaching a property as a rental unit, the key is to ensure that you have a positive cash flow each month. This means that by the time you have paid your mortgage, property taxes, maintenance fees and/or bills, you are collecting more in rent than you are paying out in bills. You will need to do some research to familiarize yourself with the going rental rate in the neighbourhood that you are looking to purchase and find an area where you can bring back a positive cash flow.

You can turn a pre-construction home into a rental property, however, it can be advantageous to buy an existing home rather than a pre-construction property when you are looking to treat it as a rental. Existing homes will more frequently have finished basements with separate entrances, or have carved out separate living areas of the home for more than one tenant.

Buy and Sell

Buying and selling properties is not a new concept. We have all seen television programs that glorify this process and make it seem like anyone can do it. While there are some dangers with “flipping” properties, with the right research and skillset there is a huge opportunity for profit with this practice.

When looking for a property to flip you typically want to find a listing that is below market value or a property that is considered to be a fixer-upper. When buying something under market value the seller is often looking for a quick sale and if you can meet those requirements you can find yourself a great listing and often pay less for the property than it is worth. With a fixer-upper, the value comes with taking on renovation projects that others may not want to and then selling the home for more than the cost of your purchase price plus the amount that you put in for the renovations.

Take some time to learn the basics about your local real estate market and the surrounding markets and consider making real estate your next investment piece in your portfolio. To help fast-track the learning process, get in touch with a real estate agent and let them do some of the legwork for you.