Tags: Neighbourhood Revitalization and Investing

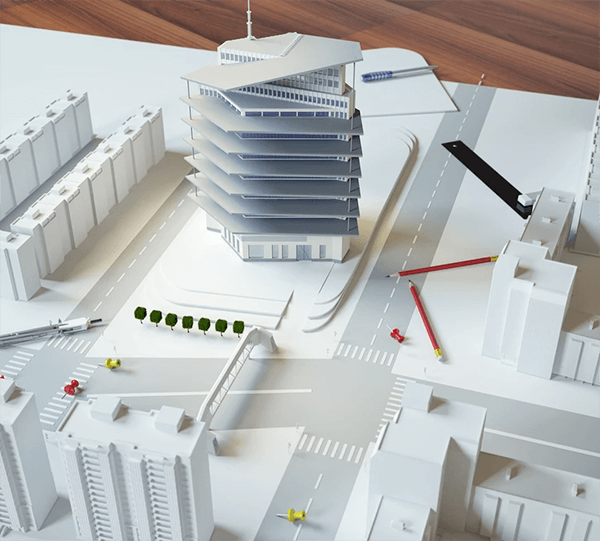

Neighbourhood Revitalization is a modern interpretation of Urban Renewal. Urban renewal was common in the post war years. It was achieved through government policies intended to clear blighted areas of inner cities and create opportunities for higher order housing and businesses. The primary purpose of urban renewal was to restore economic viability to an area by attracting external private and public investment and to encourage business start-ups. Post War Urban Renewal plans usually incorporated large public housing components. These projects had varying success rates and many lessons were learned. Modern interpretations in the form of neighbourhood revitalization plans are usually based on government policies that lay the framework for private developers to build residential projects in line with the policy.

Recent Government Policies such as the Places to Grow Act 2005 and the Ontario Greenbelt Act 2005 were implemented to limit urban sprawl and to protect environmentally sensitive land around the GTA. These policies effectively limit future development in the GTA to the existing urban area. In order for this to be achieved while still allowing for development underutilized areas of the city must be redeveloped. Former industrial sites, abandoned rail lands, and underutilized retail or parking structures are prime areas set for redevelopment. These policies encourage redevelopment of such land as well as intensification in existing areas to support growth.

Often former industrial areas do not seem desirable when development is initially proposed and prices often reflect this. However, this is the best time to invest. Cityplace a large development between Bathurst and Spadina along with the area surrounding the Rogers Center were former industrial sites and rail lands. This was not seen as a desirable place to live when development was first proposed and prices were initially low as a result. Now that these lands are almost fully developed and there are few signs of their former industrial past property values have gone up significantly. Buying into an area undergoing revitalization early will show maximum returns.

Toronto’s Eastern Waterfront, the Port Lands, and areas of South Etobicoke still have large amounts of industrial land. Official Plans designate these areas as high growth potential meaning they will be converted from industrial to residential uses. Initial condo developments will be less desirable and prices will reflect this. As more development occurs and more neighbourhood amenities are created prices will increase. For the highest return on investment it is recommended to invest in these areas over already established areas.